Can we define what we mean by Value? | Creating and Measuring Value

If we want to claim that we are doing Value-based management, we have to be clear about what value is. The concept "Value" is one that has been intriguing me for a long time. It carries an obvious good vibe to it but its definition is rather fuzzy. I want to explore this concept in more depth.

If you've known me for any length of time, you have at least once, and likely more than once, rolled your eyes at my obsession with defining concepts, words, categories and so on. It's my very own TOC, being literally obssessed with making sure we don't use important words whose meaning we can't articulate.

The reason for this is that I know that the conviction power that certain words have, hinges entirely on their being semantically flexible. You can say certain words, they will float into your audience's head as a kind of meaning potential and take on any semantic value that fits nicely into your listener's pre-existing mental map. Well, I think that once in a while, it's good to collapse the wave function of concepts and force them to take a specific value.

The concept "Value" is one that has been intriguing me for a very, very long time. First of all, I like what it ostensibly stands for, that it's the property of what is valuable. I like that, and I have always insisted that in all that we do, we are able to articulate the value of every action that we do.

I've also always felt that, while this concept carries an obvious good vibe to it, and that it has a characteristic of "you know it when you see it", its definition is rather fuzzy.

Don't get me wrong: when you do something, articulating what is valuable about what you're doing is not difficult. It requires some discipline, information and rational thought. No, the problem is to define, in general, what the concept "value" actually means when it's used as the object. More precisely, I want to clarify what we mean when we say that we should "optimize for business value", "create value" or other such trendy value-based management terms.

Let's start by reviewing some possible definitions that can pop into our heads.

- The marketing definition: Value is the reason why customers will purchase something. This is often literally called the "Value Proposition". It's a proposition, a narrative about what benefits a purchase will bring you.

- The sales definition: Value is the price of something. "Price" and "value" can be used interchangeably in some sentences, such that "what does this item cost?" is a synonym to "what is the value of this item?". It's a number of units of currency that you need to exchange for having access to the item, and it is determined by the supply and demand for the item. This is the "Sales Value".

- The CFO's definition: Value is the total of future cash-flows generated by a project or a business, discounted by a compound rate representing average expected returns given risk and inflation. This amount is literally called "Net Present Value".

So in other words, the Value Proposition will justify a Sales Value, which, cumulated over time, will in turn generate a Net Present Value.

So it seems that the term "Value" only has a specific meaning if it is associated with some other concept. It refers to a property of something else. There is no intrinsic value of something, it's a property of some other character of the thing.

Does it have to be a numerical property? In other words, when I say "Net Present Value" or "Sales Value", does "Value" refer to the numerical property associated with the concept? Does it mean "the number of currency units of that thing"?

If that's what we mean by value, then this doesn't work for the "Value Proposition". This one doesn't have a single numerical value associated with it. A Value Proposition is typically a multiparametric narrative of the benefits of using a thing. There are numbers in that narrative, like time saved, cost benefits, that sort of thing, yes. But there are also things that are not numbers, like satisfaction, ease of use, knowledge produced or required in using the thing, images, impressions, trust, reliability, social good, environmental benefits, etc.. Let's call these for now "Intangible Value".

Each of these elements of Intangible Value, when taken individually and in context, if you asked the Laplace demon to run a complete and all-knowing root cause analysis on them, would lead to some units of currency being generated or saved at some point in some, or most, cases. For instance, if you trust the thing, then you have confidence in the lower probability of the thing failing, or that you will get great service along with it, thus reducing your total cost of maintenance or giving you a higher output over time. But can you tell by how much? Is it actually empirically true or does it just make your decision-making easier, which is a benefit in and of itself? In other words, either:

- you can concretely reduce these intangible items to numbers that can be put in a CFO's business case, in which case the Value is no longer "Trust" but it's a productivity increase number, or a cost-reduction number, and that's a tangible benefit;

- or such raw numbers associated with the Intangible Value are remote, tentative, elusive, cumulative, stochastic and cannot be quantified, because they are conditional to many other properties of the world in which the thing being valued exists.

- or, it's also possible that some value essential for driving economic activity is not quantifiable in currency units in any way, that the benefits are truly both intangible and essential.

Plus, these benefits depend on who is doing the valuation. Is it the seller's CFO or the buyer's CFO? Or is it the HSE Officer? The brand manager? The compliance officer? The consumer?

So Value is a set of properties of things that may or may not be quantifiable and depend on the context. The Value of a given thing is also different for different people.

The Value Chain

Most items being bought by companies in the world are themselves being transformed and integrated into some other sellable good or service. That good or service will itself be given a Sales Value, and will generate additional cash-flows over time for the buyer-turned-seller and have its own distinct Value Proposition, and so on.

The first question is: How is all that value accrued?

Well, this is what defines what is called the "Value chain". It's the circulation of the cash flows generated by the thing as it is being sold, associated with other valuable things by people and machines, then sold again transfigurated in the new thing that it made possible, and so on.

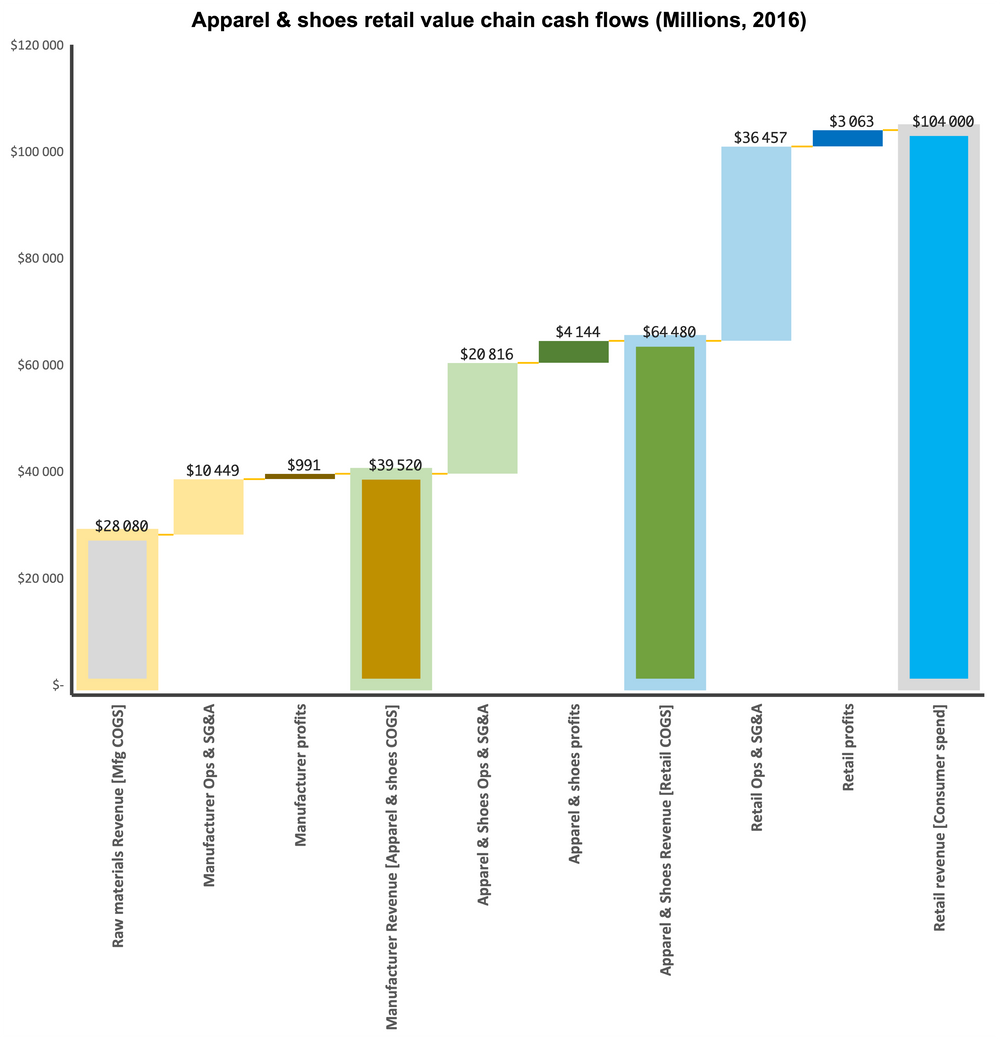

Taking the example of the Apparel & Shoes industry in 2016 (data source: Karel Cool's slides from INSEAD's Competitive Strategy module), this is what a value chain looks like from a cash-flow perspective:

I love this view: it shows clearly how the whole production chain breaks down into purchases of goods, internal costs and profits throughout the chain. It provides a holistic view of everything. It also shows nicely how the Value flows through the different players, and how the Value of one step for one of them is quite different from the Value of the same step for another. Note also that Revenue is only a technical mechanism to transfer the cash required to create Value. In this view, my revenue is the Cost of Goods Sold (COGS – here understood as literally the purchasing costs) of the next step. Revenue is not value.

What is Value, is the part of my Revenue that I can retain to either pay my labor and operations, or to book as profits to create capital or distribute returns to investors.

In the above view, the scale differences make it a little hard to see the distributions of the value that is retained (i.e. Value "captured") by each player. In other words, where the power to capture value resides in the chain.

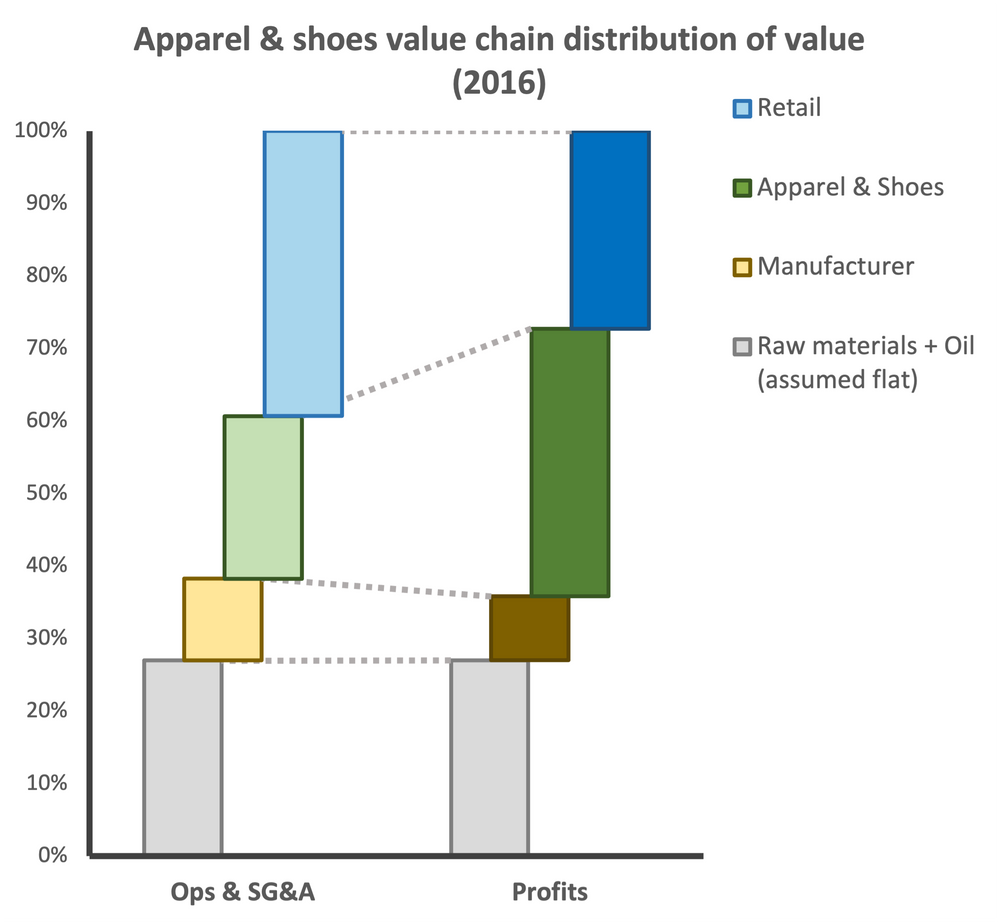

To better understand this, we can look at the percentage distribution of Ops and SG&A vs. Profits capture, with this view that is quite enlightening:

This gives a very clear picture of the proportion of Value captured. What matters here is: given the cash flows, who retains which proportion of it to pay its labor force and generate earnings, irrespective of total revenues of each player.

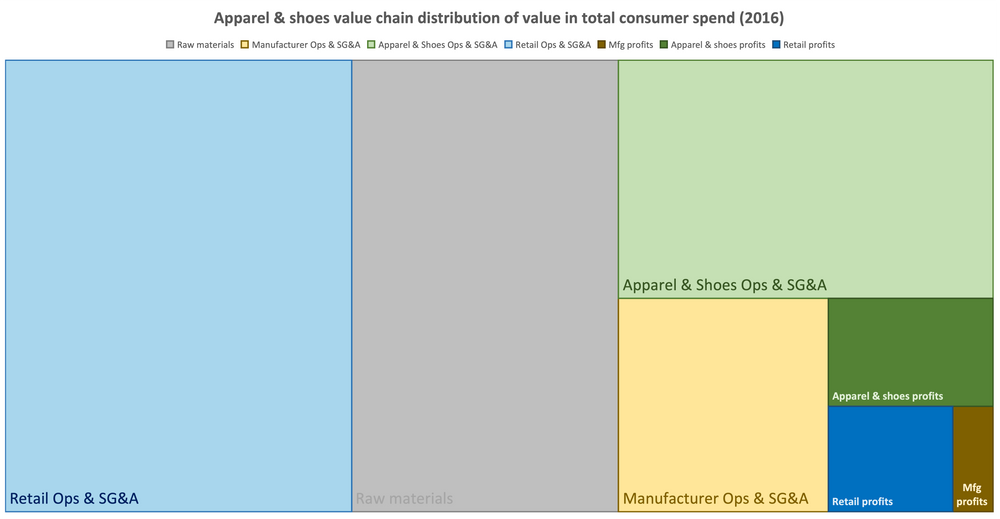

For a more synthetic but at scale view of this distribution of retained operational cost and profits, I like this way of breaking down all the spend into the various components of the chain:

Here we see a nice view of the relative weight of profits and costs that make up the total consumer spend. The nice thing about this view is that a) it also dispenses with the double display of costs and revenues and b) it is cognitively eloquent in terms of absolute proportions.

What we see in that view are the pieces of the consumer spend that are captured and spent by all the stakeholders of each value-chain step in order to move the product to the next step. The financial value of this work that goes into moving from one step to the next is called "Value Added", and is relevant for tax purposes.

This is the reason why in most OECD economies, VAT is only charged at the consumer level, because there is only one chain of value generation, and the tax can only be levied once on the value created –that can only be done at the end of the chain.

So we have a fourth obvious definition of "Value" here:

- The fiscal definition, called "Value-Add". It's the difference between the cost of the goods you bought that you need to make the thing that you sell and the price at which you sell the thing. In other words, it's your labor costs and your profit, expressed in currency units.

The Value Chain is a great tool to track the flow of value through the chain, in paticular for the quantifiable components. One thing that is obviously missing from it, however, is the benefit for the end-consumer. There has to be a reason why the consumer is willing to pay an amount of currency for the end product, and that reason, that value, is absent from the value chain representation. Do we care about it?

Interim conclusion

Looking at the question of value from this 50 thousand foot view, we can see that it needs more resolution to be operationally meaningful. Value doesn't mean one thing, it can be understood in many different ways, both tangible and intangible, from different points of view.

If we want to claim that we are doing Value-based management, we have to be clearer about what value is.

In particular, we need to be able to answer these questions:

- What is the value of a product, for the business making it and for the customer?

- What is the value of the units of currency that we use to measure value, for the seller and the buyer?

- What is the value of work for the employer, the employee and the customer?

- What is the value of innovation for the business doing it, the disrupted value chain and the customer?

- What is the value of digital for the service providers, the transformed businesses and the customer?

Once we understand the answers to these questions, then we can answer the only operational question that we really care about: when I say that I'm managing for value, what value am I talking about?

In the next series of posts I'll explore different ways to look at value and attempt to get closer to some of these answers.

If you have thoughts or interesting resources that you think are useful in this discussion, feel free to engage with me on LinkedIn. You can also subscribe to this blog below, to receive the main posts as a newsletter straight to your inbox.

Comments